3

As of 09/30/2016

3

Q3

2016

Transaction

Activity

Summary

M&A Activity Summary

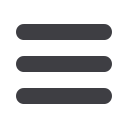

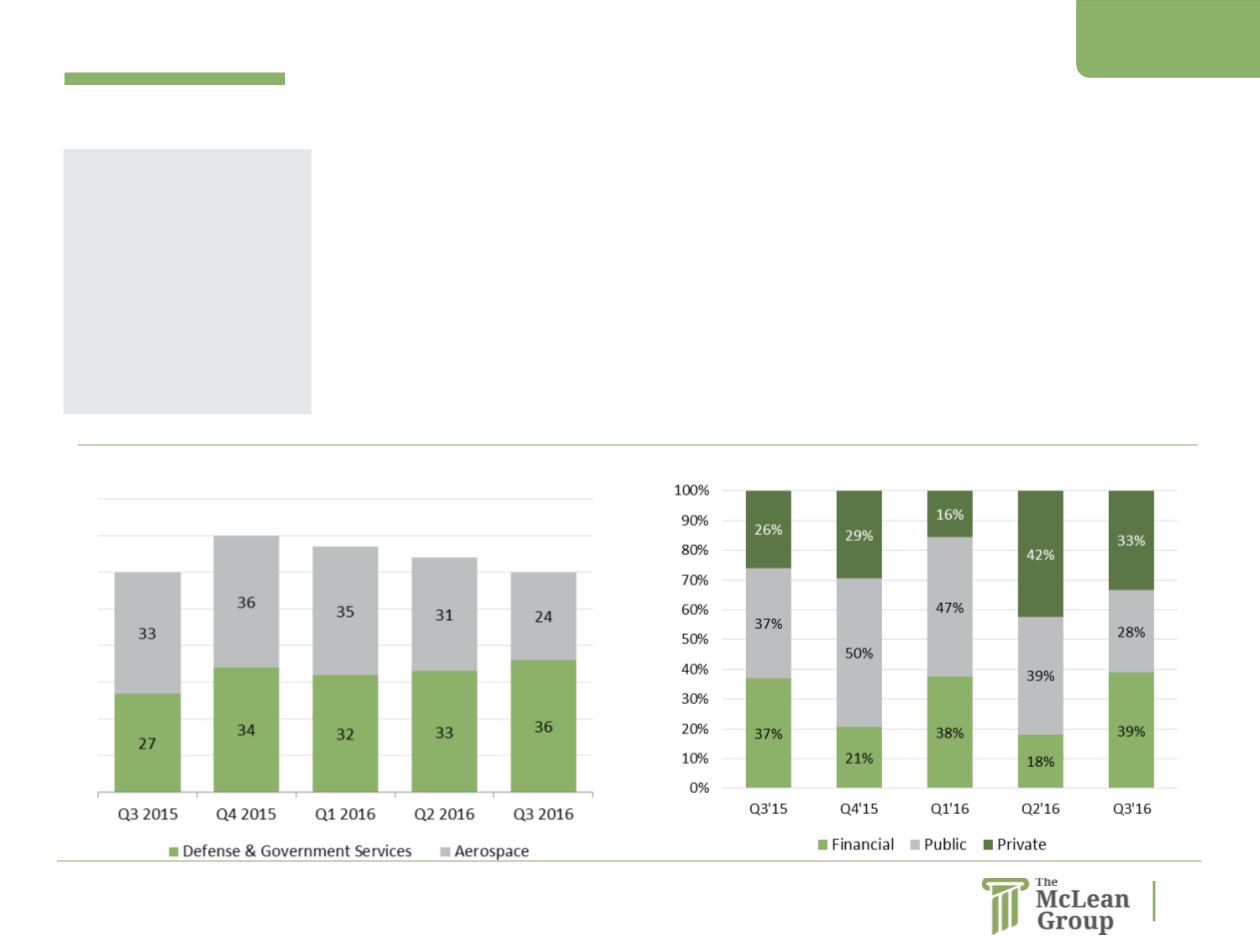

The McLean Group tracked 36 announced Defense and Government Services transactions during Q3 2016, representing

a slight increase from 33 and 32 transactions in Q2 and Q1 2016, respectively. Q3 saw a large increase in acquisition

activity by financial sponsors, representing 39% of buyer activity up from 18% in Q2. Among strategic buyers, private

companies remained slightly more active than public buyers for the quarter. The largest transactions for the quarter

involved financial sponsors, including Intel’s spin-off of its McAfee security segment to a joint venture with TPG at an

estimated enterprise value of $4.2 billion and a management buyout of Constellis Holdings by a consortium of investors

led by Apollo Global Management for approximately $1.0 billion.

North American Aerospace M&A activity decreased in Q3, down to 24 transactions from 31 in Q2. Acquisitions by buyer

were dominated by financial sponsors, representing 46% of acquisitions while public and private strategic buyers

accounted for 25% and 29% of acquisition activity, respectively. The largest transaction of the quarter was represented

by MTS Systems Corp.’s acquisition of PCB Group, Inc. for $580.0 million.

Source: Public Filings, Industry Newswires, S&P Capital IQ

Government Services Acquisitions by Buyer Type

Acquisitions by Sector