Reprinted with Permission from the Q3 2014 edition of Maritime Professional

demand did not materialize quite as expected. Global deal

counts as shown in

Figure 1

receded by more than 7% in each

of 2012 and 2013 and total reported deal dollar values mir-

rored those pullbacks. One anomaly in the data is the 15%

increase in US deals during this period. This variance was the

result of expiring Bush-era capital gains tax rates at the end of

2012. American M&A markets across most industry segments

experienced this same short-term bump, followed by a rapid

fall in deal activity in early 2013.

Though this phenomenon resulted in lower activity in early

2013, the second half of the year did produce a few deals of

interest, including the $460 million acquisition of Abdon Cal-

lais Offshore by Harvey Gulf International Marine, and Gene-

sis Marine’s purchase of Hornbeck Offshore Transportation’s

(NYSE:HOS) downstream tug and barge assets for $230

million. A notable trend in our chart data is an uncommonly

large jump in deal activity from the first half of the year to the

second, as the market recovered from the tax-driven market

irregularity.

Global View of 2014

Momentum from late 2013 has continued unabated this

year, with strong deal flow in the first half of the calendar year

and a projected strong finish both at home and abroad, based

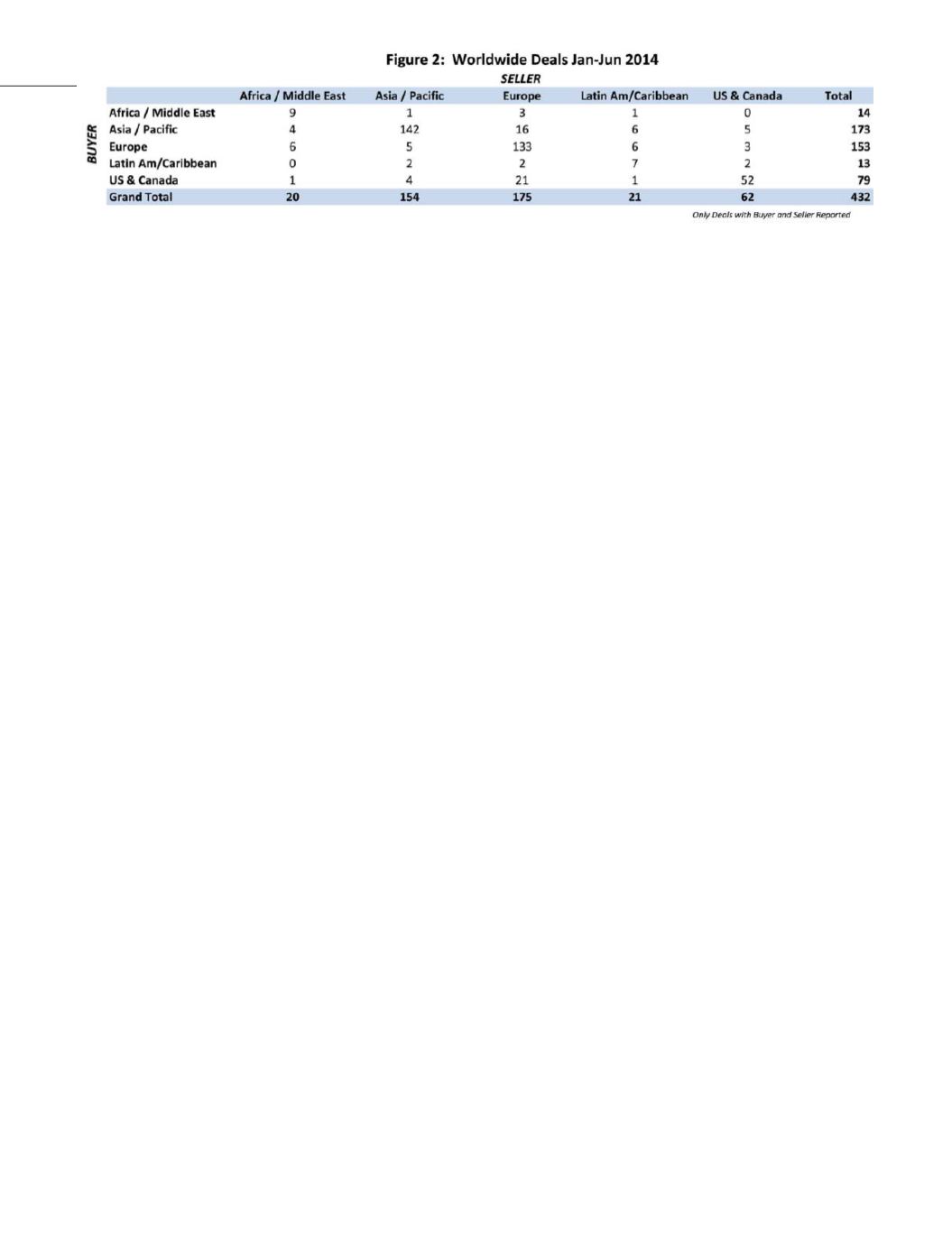

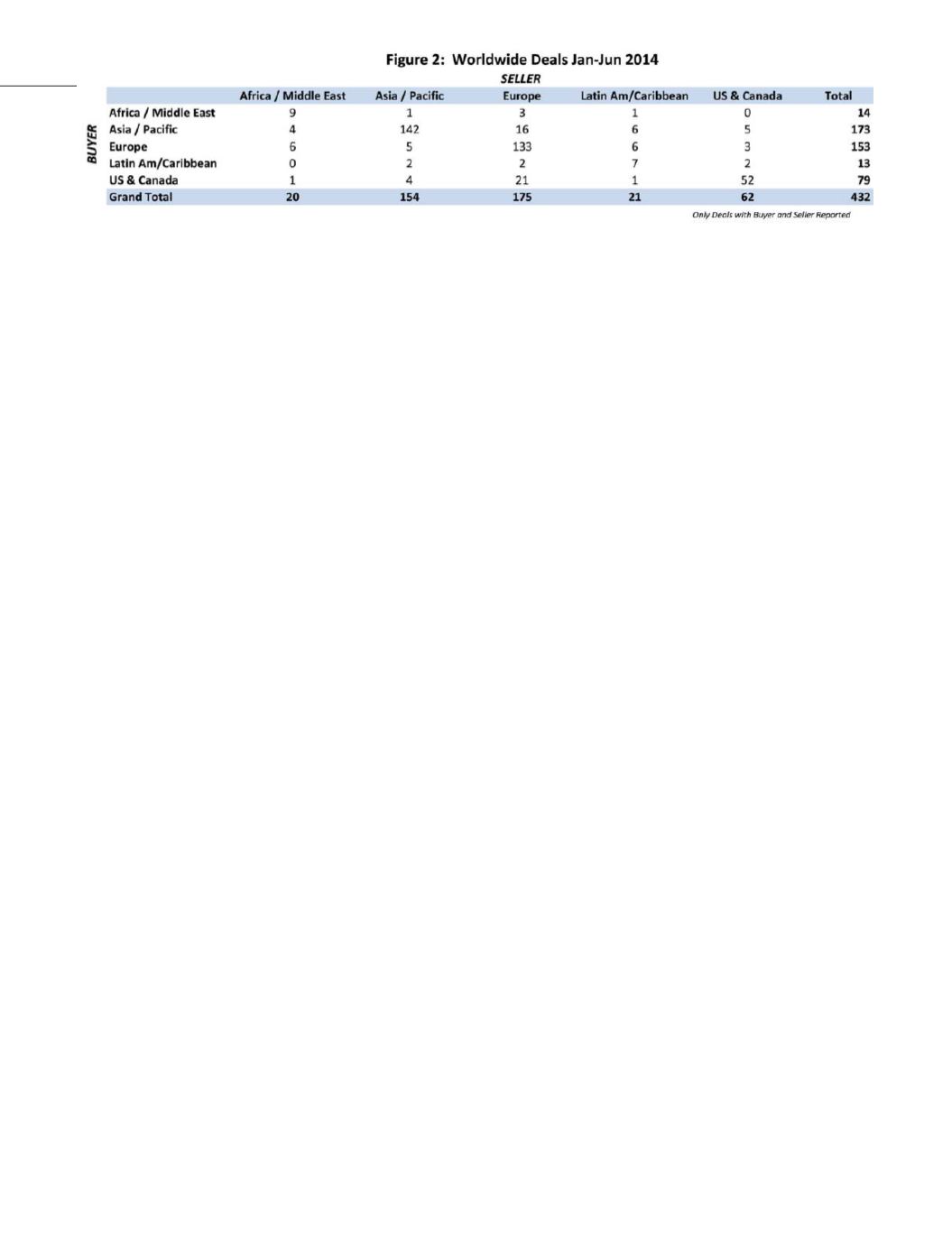

on trends and averages in previous years. Figure 2 provides

an interesting framework through which to view marine and

offshore M&A transactions on an international level.

The table in

Figure 2

exhibits the number of buyers and

sellers from each world region in the 432 transactions where

such data was reported in the first half of this year. Cross-ref-

erencing the data, a number of highlights emerge about the na-

ture of global M&A transactions in our chosen market. First,

it is clear that two regions dominate deal-making in 2014: Eu-

rope andAsia/Pacific. Furthermore, the numbers show that the

bulk of all deals are completed between buyers and sellers that

are both in the same region. Leading this trend are companies

in the Asia/Pacific region, where 142 deals were closed with

both buyer and seller from that region. The same trend holds

true in each of our global zones, though the total deal counts

are much lower across the board for areas outside of Asia and

Europe.

The data in this table also enable one to identify which re-

gions are net sellers and which are net buyers of companies in

the industry. For example, we see that companies in the Asia/

Pacific region were on the “buy-side” in 173 transactions, but

on the “sell-side” in only 154 cases. Europe almost perfectly

balanced this incongruity in Asia/Pacific, with 153 buys to

175 sells. We famously see this same trend in government

bond purchases, where China reaches out to invest surplus

funds in foreign assets with steady performance. However, it

is interesting to note that though China was present in a large

number of the Asia/Pacific deals, there were significant play-

ers in sizeable transactions from diverse geographies includ-

ing Malaysia, Qatar, Indonesia and The Philippines.

Recent Transactions

There have been several interesting technology-focused

deals this year in the maritime and offshore segments. In June,

TE Connectivity (NYSE:TEL) completed its acquisition of

privately-held SEACON, a provider of systems and connec-

tor technology for the military marine and subsea sectors,

including ROV’s, AUV’s, oil and gas, and oceanographic ap-

plications. Satellite communications systems provider KVH

(NASDAQ:KVHI) made an interesting acquisition in Lon-

don-based Videotel, a producer of training films and e-Learn-

ing services for the commercial maritime industry. Videotel

products enable KVH to continue to provide valuable content

to their critical maritime niche. Finally, Teledyne Technolo-

gies (NYSE:TDY) confirmed its focus on the autonomous

marine vehicle market by entering a strategic partnership with

an investment in San Diego-based Ocean Aero. Ocean Aero is

designing a unique product known as the Submaran, a vehicle

capable of operating in both surface and sub-surface environ-

ments.

Such marine technology deals are notable and interesting,

but the bulk of investment dollars continue to flow to the oil

and gas sector. Nine of the top 10 deals so far in 2014 are

foreign offshore asset deals. Both in the Americas and abroad,

the steady growth of global energy demand in tandem with

ever-improving production technologies should continue to

drive healthy M&A activity for the foreseeable future.