Reprinted with Permission from the Q3 2014 edition of Maritime Professional

T

he broad market for maritime and offshore merg-

ers and acquisitions has been shaped by turbulent

macroeconomic conditions and shifting internation-

al business trends in recent years. Analysis of deal

data from the past five years enables us to examine how the

global recession and subsequent uneven recovery have been

reflected in these large and vital worldwide markets segments.

Worldwide M&A Story Since 2010

Across the globe, maritime and offshore mergers and ac-

quisitions have recovered from the depths of the recession. In

2009, deal activity fell precipitously with a worldwide deal

count of just 656 for the entire year. Asset-heavy industries

were plagued by suppressed demand and restricted access to

capital. This low point was marked in the US by a number of

distressed deals and defaults, including the memorable Chap-

ter 11 filing by U.S. Shipping Partners L.P.

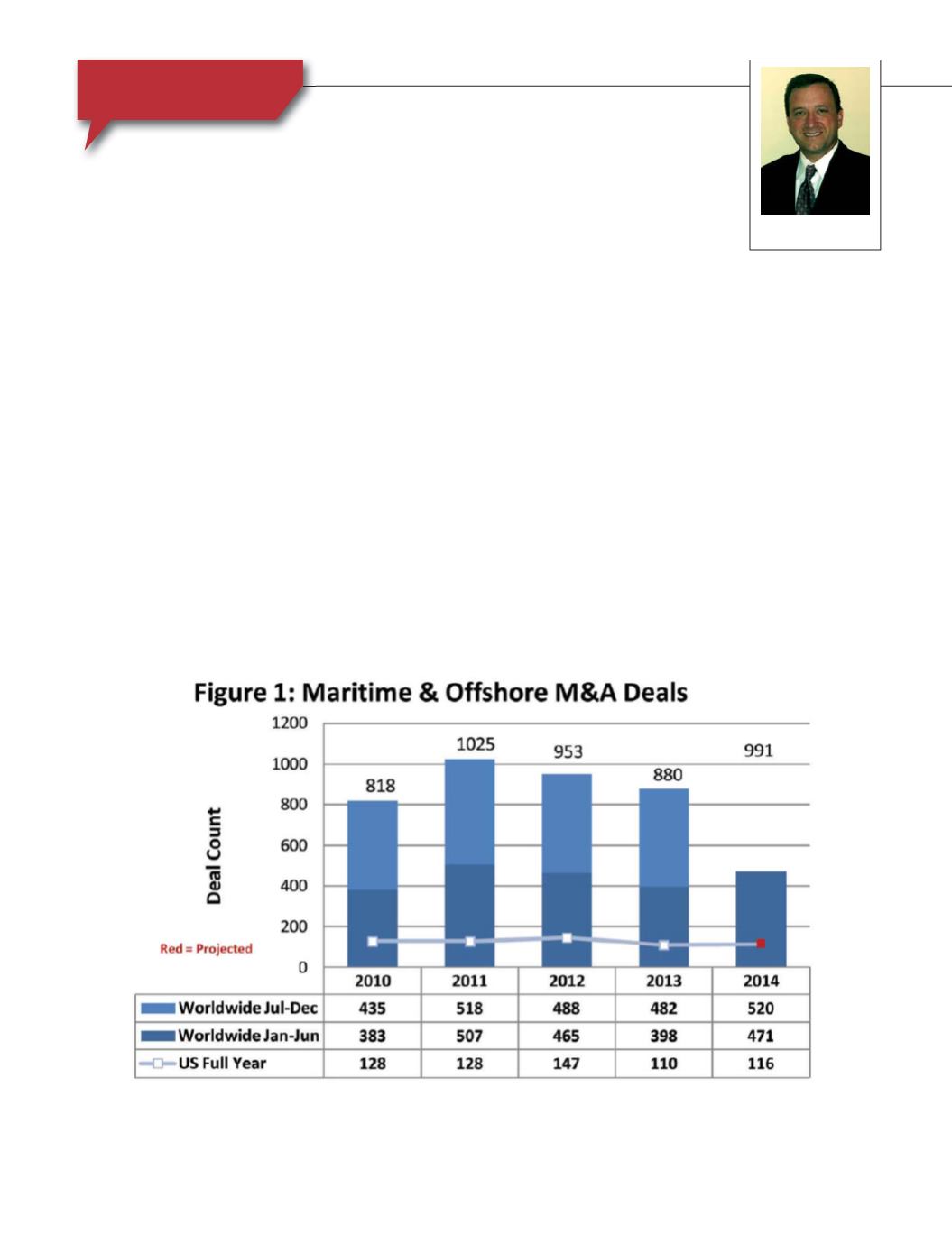

Figure 1

shows

both worldwide and United States deal counts from 2010

through the first half of 2014. From the low of 2009, move-

ment in the market recovered quickly, with 818 deals com-

pleted during the following calendar year.

By 2011, the energy markets experienced a wave of activ-

ity as optimism grew and oil prices climbed steadily through

the spring. A number of high-profile deals were announced,

among them, Ensco’s (NYSE:ESV) acquisition of Pride In-

ternational in a transaction valued at more than $9 billion.

The same year also brought Transocean’s acquisition of Aker

Drilling for $3.4 billion and the acquisition of K-SEA by Kir-

by Corp (NYSE:KEX) for $618 million. K-SEA was just one

of a handful of Kirby deals in 2011, and the inland/coastal liq-

uid transport giant continued its buying spree in 2012 with the

$298 million acquisition of Penn Maritime and the purchase

of another tug and barge operator, Allied Transportation, for

$116 million.

After the surge of deal activity in 2011, the markets fell into

a two-year decline, as oil prices fell and anticipated shipping

Maritime and Offshore M&A Evolution

Insights

By Harry Ward