‒ Aerospace M&A is currently fueled by several

positive factors, including growing passenger

traffic, global economic expansion, and a record

commercial aircraft backlog.

‒ The Aerospace M&A landscape has witnessed a

number of large deals during the first three

quarters of 2018 including the recently

approved purchase of Rockwell Collins by UTC

for $30 billion and Boeing’s $4.2 billion

acquisition of KLX Inc.

‒ Transdigm’s recently announced acquisition of

Esterline for $4.0 billion represents further

large-scale consolidation in the sector.

‒ While larger deals capture the headlines, there

is strong buyer interest in components,

subsystems, MRO, logistics and aerostructures.

‒ Aside from regulatory mandated divestitures,

we expect strategic buyers to continue portfolio

shaping activities that will provide additional

acquisition opportunities.

‒ Overall, Aerospace deal activity remained brisk

in the third quarter of 2018 with 38 closed

deals, up 15% over the third quarter of 2017.

‒ Potential market headwinds due to uncertainty

from US elections (i.e., mid-terms and 2020

presidential), higher oil prices, and increasing

interest rates have not had an impact on deal

flow.

‒ The McLean Group continues to see strong

interest for Aerospace companies from strategic

and financial buyers.

We expect the deal

environment to remain active into 2019 with

quality companies garnering attractive

valuations.

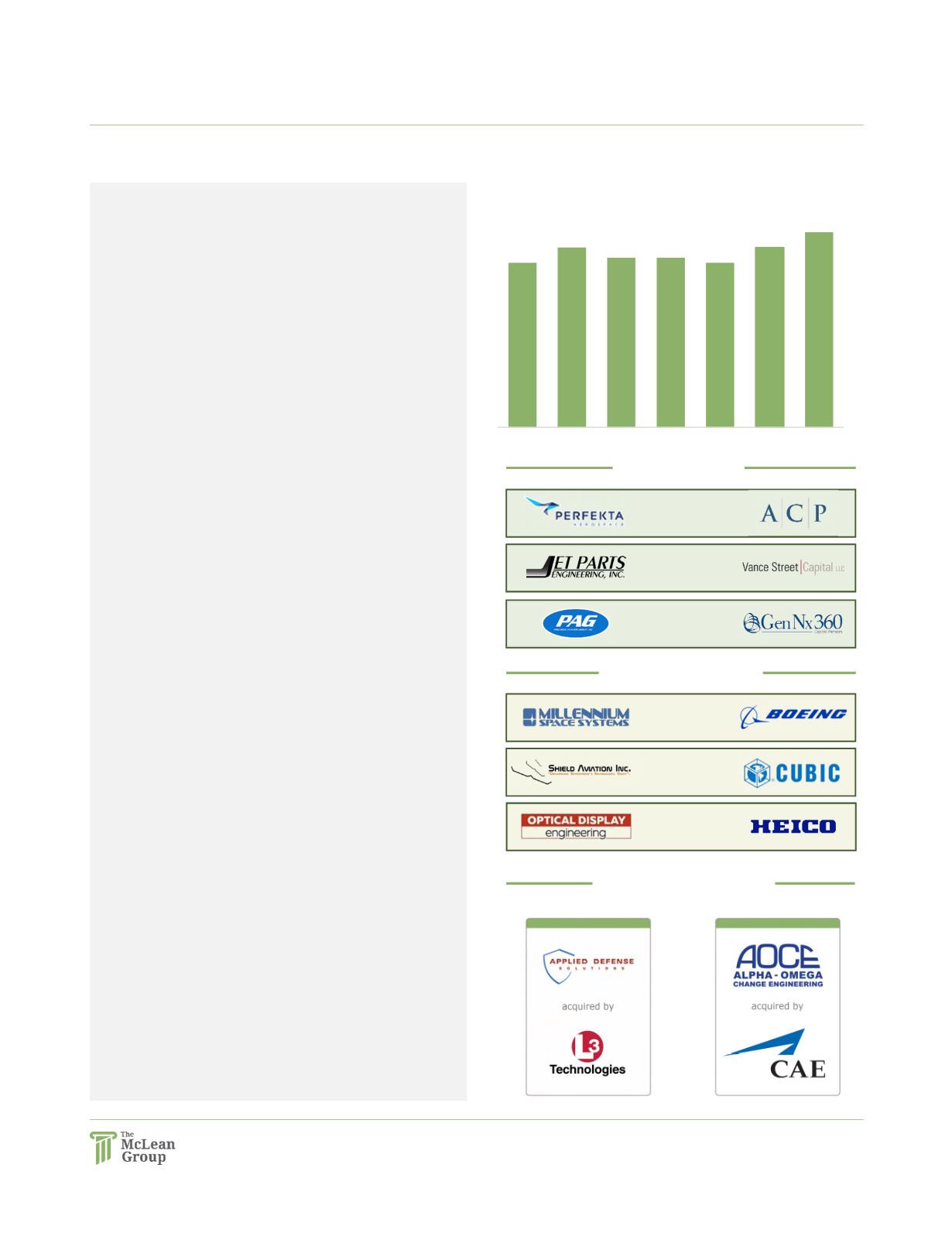

Aerospace M&A Transactions

M&A Activity Summary

4

AEROSPACE TRANSACTION ACTIVITY

Public Companies

Acquired By

Acquired By

32

35

33 33 32

35

38

Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 Q2 2018 Q3 2018

Q3 2018 TMG Deals

Acquired By

Acquired By

Private Equity

Acquired By

Acquired By