3

First Quarter 2016

Industry Trends

(Defense and Gov. Services)

Acquisition Spotlight

In January,

Lockheed Martin

announced that it will merge its

Information Systems and Global Solutions (“IS&GS”) segment with

Leidos Holdings Inc.

in a deal valued at approximately $5 billion.

As a result of the transaction, Lockheed shareholders will receive a

one-time payment of $1.8 billion and shares in Leidos valued at

approximately $3.2 billion. The deal allows Lockheed to focus on

its aerospace and defense business. Upon the transactions’

completion, Leidos will be a $10 billion leader in enterprise focused

high-end technical services. Over the last several years the

commercial IT market has become increasingly competitive, and

Leidos hopes to achieve some economies of scale through this

transaction. We expect this consolidation trend to continue as

small and medium size companies try to remain competitive in this

increasingly cut-throat industry. Since being spun-off from SAIC in

September 2013, Leidos has been relatively quiet in the M&A

landscape, while Lockheed has made focused acquisitions in its

IS&GS business segment.

As part of the merger several of Lockheed’s largest contracts will

transition to Leidos:

• IS&GS’s $4.6 billion contract to secure the Global Information Grid

of the Defense Department. This contract is Lockheed’s second-

largest contract, with revenue north of $300 million in fiscal 2015

• IS&GS’s FAA contracts. Lockheed has been one of the FAA’s

largest contractors and has played a critical role in creating the

basis for the Next Generation Air Transportation System

• As a result of the merger, Leidos will regain the General Services

Administration’s Alliant contract vehicle, retained by SAIC in their

divestiture

Sources:

1

OMB Summary of Receipts, Outlays, and Surpluses or Deficits;

2

Associated Press; Industry Newswires; S&P Capital IQ;

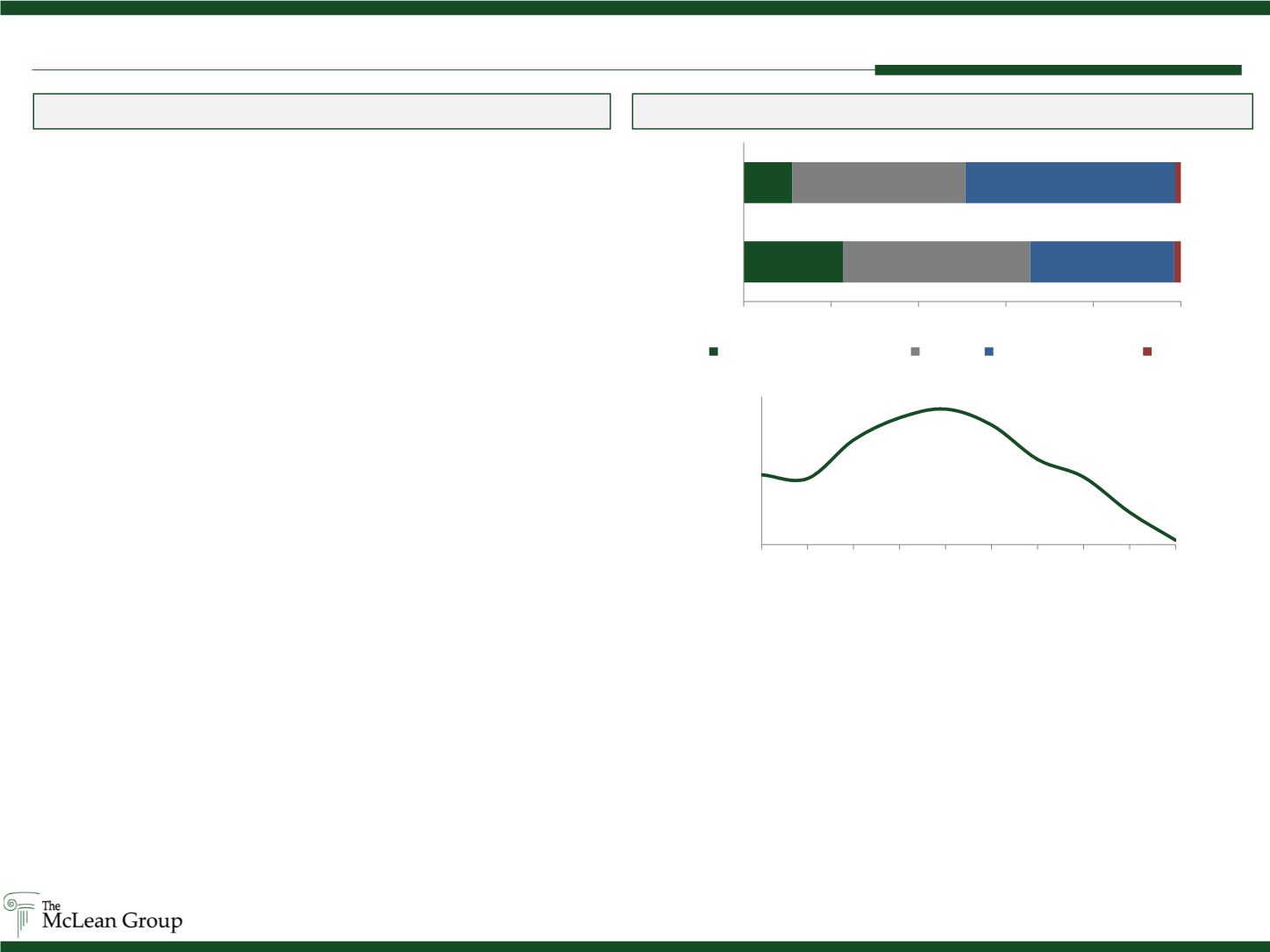

ARMY.MILThe ongoing drawdown of U.S. military operations in Iraq and

Afghanistan, as well as recent escalation of tensions with North

Korea and in the South China Sea, continues to shift the deployment

of active duty military personnel to regions outside of the Middle East.

This regional shift, as well as further decrease in total active duty

headcount, supports further reliance on contractors globally, and in

the Middle East in particular. In a recent report, the Pentagon

disclosed that the number of private contractors in Iraq grew by

approximately eight times in 2015, in addition to a steady contractor

presence in Afghanistan and the CENTCOM AOR.

23%

11%

43%

40%

33%

48%

2%

1%

0%

20%

40%

60%

80%

100%

2014

2015

Middle East and South Asia Europe East Asia And Pacific Other

1.31 M

1.34 M

1.37 M

1.40 M

1.43 M

2006 2007 2008 2009 2010 2011 2012 2013 2014 2015

Active Duty Military Personnel By Location and Total Headcount