2

First Quarter 2016

M&A Analysis

Source: Public Filings, InfoBase; Capital IQ as of 3/31/2016

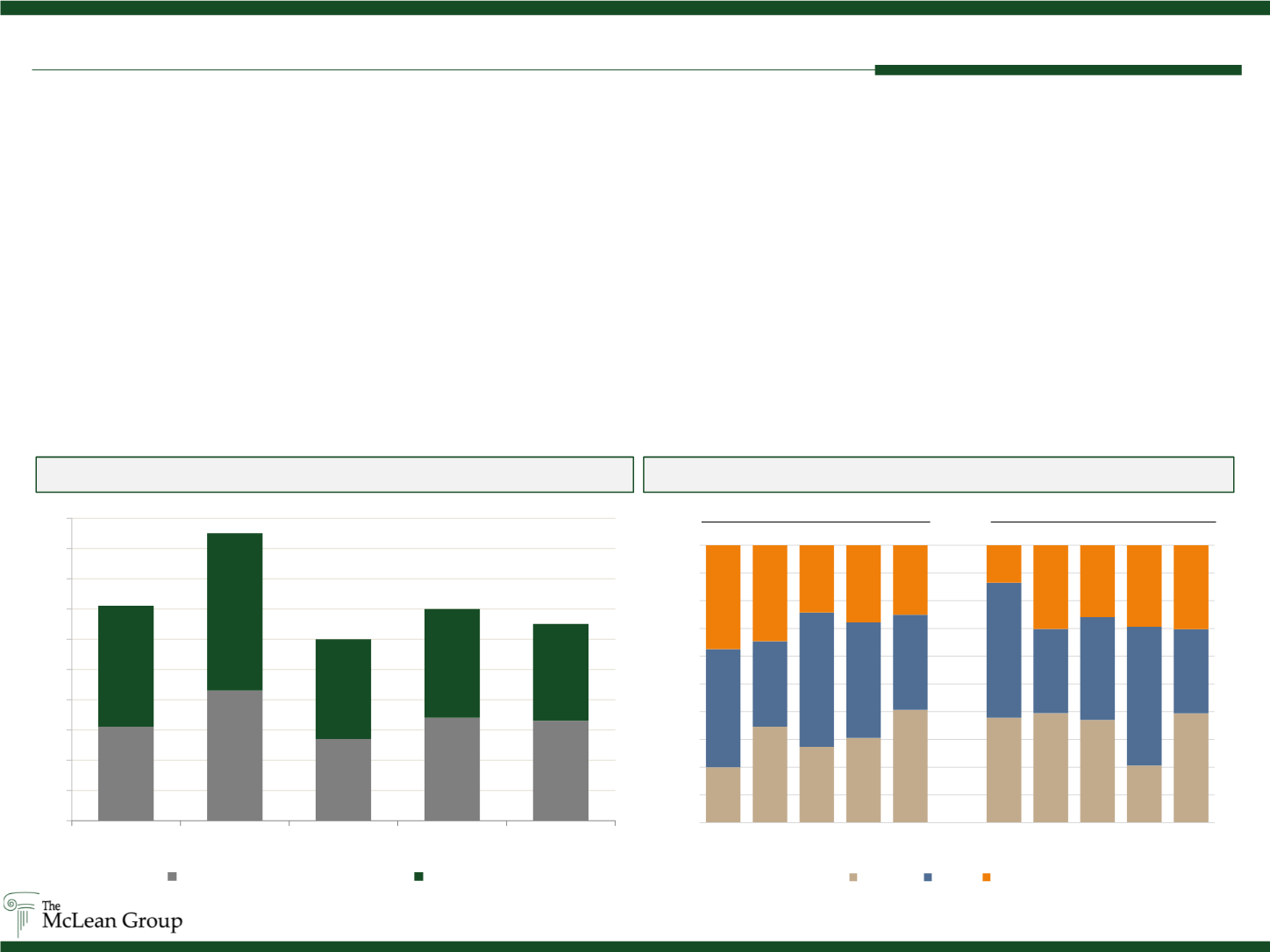

Quarterly Transactions by Buyer Type

Recent Transaction Activity by Quarter

Aerospace

Defense & Gov. Services

The McLean Group tracked 33 announced Defense and Government Services sector transactions during Q1 2016, up from Q1 2015 and in line

with Q4 2015. Public buyer presence, which was evident throughout 2015, diminished slightly in Q1 2016 as buyers digested recent purchases

and shaped portfolios with continued divestitures. Lockheed Martin announced it will merge its realigned Information Systems & Global

Solutions business (“IS&GS”) with Leidos, forming the largest government services firm in the space with combined revenue in excess of $10

billion. CACI’s UK business unit, CACI Ltd., acquired two smaller private IT companies – one for its analytics qualifications and the other for its

cybersecurity subject matter expertise. Private equity companies represented the most active buyer category in the first quarter. Notable deals

include Platinum Equity’s acquisition of PAE from private equity firm Lindsay Goldberg, CM Equity’s portfolio company PSS’ add on of Tetra

Concepts, and Arlington Capital Partners’ purchase iRobot’s Defense & Security Business.

North American Aerospace M&A activity receded in Q1, falling to 32 announced transactions. Private equity buyers took advantage of this lull of

activity by filling the the void in Q1. KKR announced it will acquire Airbus’ Defense and Electronics business unit, which is comprised of airborne

platforms and ground systems, for $1.2 billion. The acquisition is expected to close in Q1 2017. Airbus continued to shed non-core assets and

divested its US satellite communications business to Satcom Direct. Enlightenment Capital made a strategic investment in Aurora Flight

Sciences, a manufacturer of unmanned systems and aerospace vehicles for military and commercial customers. Lastly, Berkshire Hathaway

completed its previously announced acquisition of Precision Castparts in January for $37.2 billion.

31

43

27

34

33

40

52

33

36

32

71

95

60

70

65

0

10

20

30

40

50

60

70

80

90

100

Q1 2015

Q2 2015

Q3 2015

Q4 2015

Q1 2016

Defense & Government Services

Aerospace

20%

35%

27% 31%

41%

45% 40% 37%

21%

39%

43%

31% 48% 42%

34%

58%

30% 37%

50%

30%

38% 35%

24% 28% 25%

16%

30% 26%

29%

30%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Q1'15 Q2'15 Q3'15 Q4'15 Q1'16

Q1'15 Q2'15 Q3'15 Q4'15 Q1'16

Financial

Public Private