Reprinted with Permission from the Q2 2014 edition of Maritime Professional

”

Financial Risk and M&A Deals

Financial transactions, particularly large ones, involve a

complex and in-depth evaluation of risks by players on both

sides of the deal. In Mergers and Acquisitions, sellers gener-

ally seek to diversify their portfolios by reducing their expo-

sure to the risk of holding ownership in the subject company.

Meanwhile, the buyer and its advisors expend often enormous

time and resources in the analysis of the risks they are taking

on during the “due diligence” period.

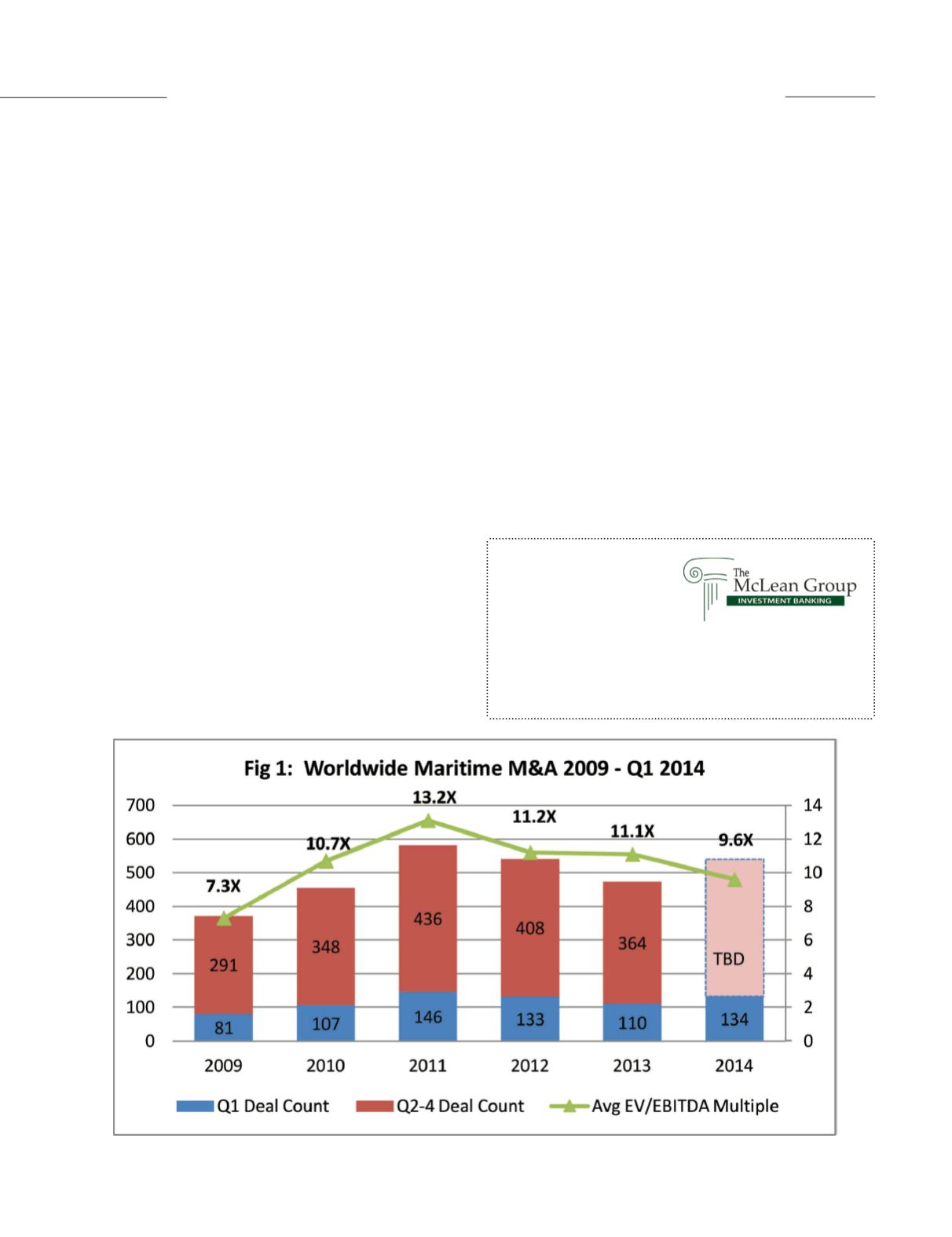

Over time, we can assess risk tolerance levels in the market

by examining compiled data from a collection of transactions

where deal metrics have been reported. Figure 1 displays all

worldwide marine and port-related deals drawn from a number

of proprietary data sources. Explaining the chart in brief, the

blue section of the columns displays the deal count for the first

quarter of each year, whereas the red section of the columns

shows the number of deals for the remainder of that year. The

green line tracks the ratio of average Enterprise Value (EV)

to Earnings Before Interest, Taxes, Depreciation and Amorti-

zation (EBITDA). EV is just the total value of the company,

including all of the debt and equity (stock value) that make up

the company’s balance sheet. EBITDA is really the cash flows

that a buyer will have to finance the transaction without regard

to the current financial arrangements of the target company.

Figure 1 shows that in the recovery years from 2009 to 2011,

deal counts as well as value ratios increased each year. The high

EV/EBITDA number in 2011 was affected by some Asian port

deals that had very high reported values, but the trend is an inter-

esting subject for analysis. In effect, buyers showed a growing

willingness to accept increasingly higher risk over this three-year

period, paying a higher price for the same or slightly higher cash

flows. Since that time, enthusiasm on the buy side has waned a

bit in the aggregate, though it should be noted that a thorough

analysis would involve study of the type of deals and even in-

dividual transactions to get a clear picture of the risk landscape.

Risk is a central issue in almost every facet of maritime and

offshore industries. Markets are both affected by and actually

created by the many risks inherent in maritime activities. This

explains why marine finance involves a complex set of ac-

tivities that are focused on identifying and quantifying risk,

and then allocating resources based on the expected risks in a

given transaction.

Financial transactions, particularly large ones, involve a complex

and in-depth evaluation of risks by players on both sides of the

deal. In Mergers and Acquisitions, sellers generally seek to diversify

their portfolios by reducing their exposure to the risk of holding

ownership in the subject company.

The Author

Harry Ward

leads the

transportation and logistics

practice at The McLean Group,

a middle-market investment bank based in the Washington, DC

area. Mr. Ward has executive management experience in the

marine industry and focuses on mergers and acquisitions for

mid-sized companies. He is a US Naval Academy graduate and

earned an MBA at San Diego State University.