5

Second Quarter 2013

Company

Quarter

Ending

Revenue EPS

3/31/2013

-1.8%

8.0%

3/29/2013

6.2%

8.2%

3/31/2013

7.2%

14.2%

3/31/2013

2.4%

18.7%

3/31/2013

3.3%

21.9%

3/31/2013

2.1%

8.8%

3/31/2013

-2.7%

0.0%

3/29/2013

-3.8%

60.2%

3/31/2013

0.1%

-6.9%

5/3/2013

4.8%

-8.0%

3/31/2013

9.0%

59.4%

3/31/2013

-1.9%

4.5%

3/31/2013

-4.0%

-2.8%

3/29/2013

-0.4%

0.0%

3/31/2013

3.6%

8.1%

3/31/2013

0.1%

0.0%

3/31/2013

2.4%

8.5%

3/31/2013

3.5%

100.0%

3/31/2013

6.7%

-125.0%

3/31/2013

11.7%

87.5%

3/31/2013

-10.5%

-13.2%

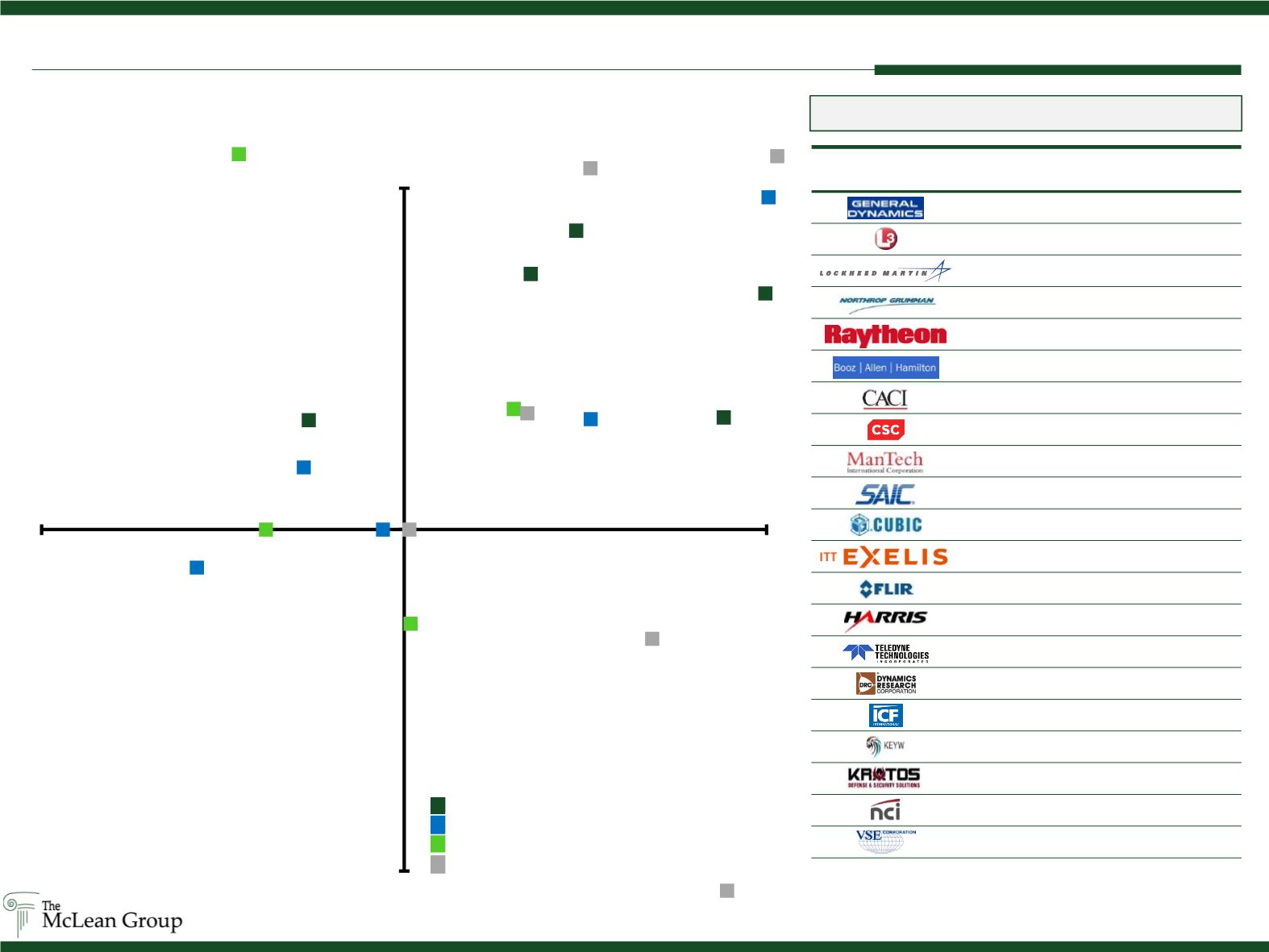

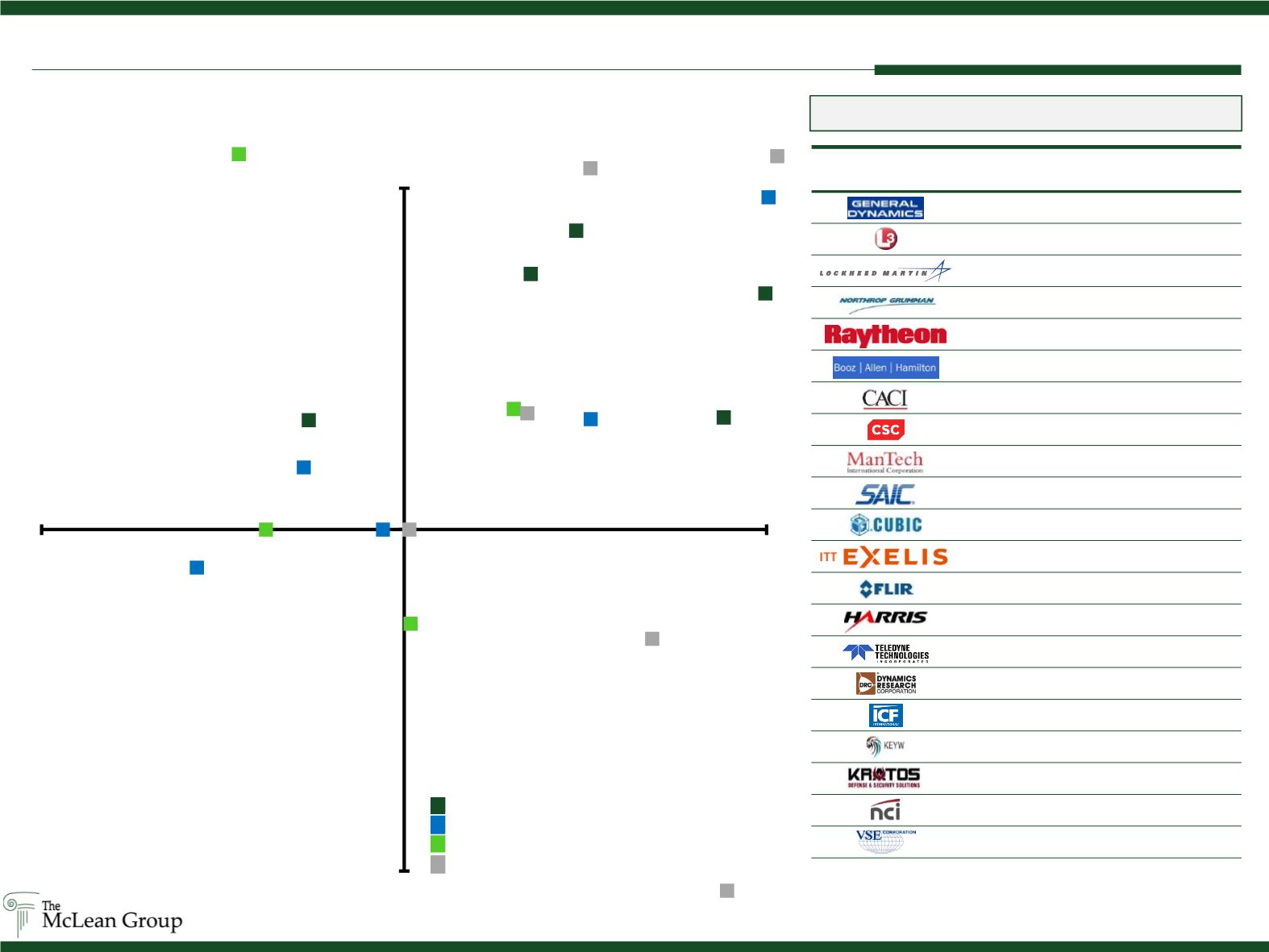

Most Recent Quarterly Financial Results

(Defense and Gov. Services)

Most Recent Quarterly Earnings Suprise

1

Source: Public Filings; Capital IQ as of 06/28/13

Defense Prime Index

Defense Systems Index

Government Services Index

Middle Market Index

Most Recent Quarterly Earnings Suprise

1

1

Earnings Surprise is calculated as the difference of a Company’s most recent

quarterly financial results from Capital IQ analyst consensus estimates

GD

Raytheon

Teledyne

Harris

Northrop

L-3

Booz

CACI

FLIR

DRCO

ManTech

ICF

Exelis

SAIC

-25.0%

25.0%

-7.0%

7.0%

EPS

Revenue

VSE

CSC

KEYW

Kratos

7.0%

VSE

CSC

KEYW

Kratos

Lockheed

Cubic

NCIT

-25.0%

25.0%

-7.0%

7.0%

EPS

Revenue

VSE

CSC

KEYW

Kratos

Lockheed

Cubic

NCIT

-25.0%

25.0%

-7.0%

7.0%

EPS

Revenue

KEYW

Kratos

Lockheed

Cubic

NCIT

25.0%

EPS

VSE

CSC

KEYW

Kratos

Lockheed

Cubic

NCIT

-25.0%

25.0%

-7.0%

7.0%

EPS

Revenue

VSE

CSC

KEYW

Kratos

Lockheed

-25.0%

%

7.0%

evenue