Reprinted with Permission from the Q3 edition of Maritime Professional

W

orkboat and offshore marine markets have

been gaining strength over the past three

years. A resurgence of oil production in the

Gulf of Mexico has brought orders for new vessels, ma-

jor oil companies are ramping up their presence in the

region, and Gulf-oriented state governments are aligning

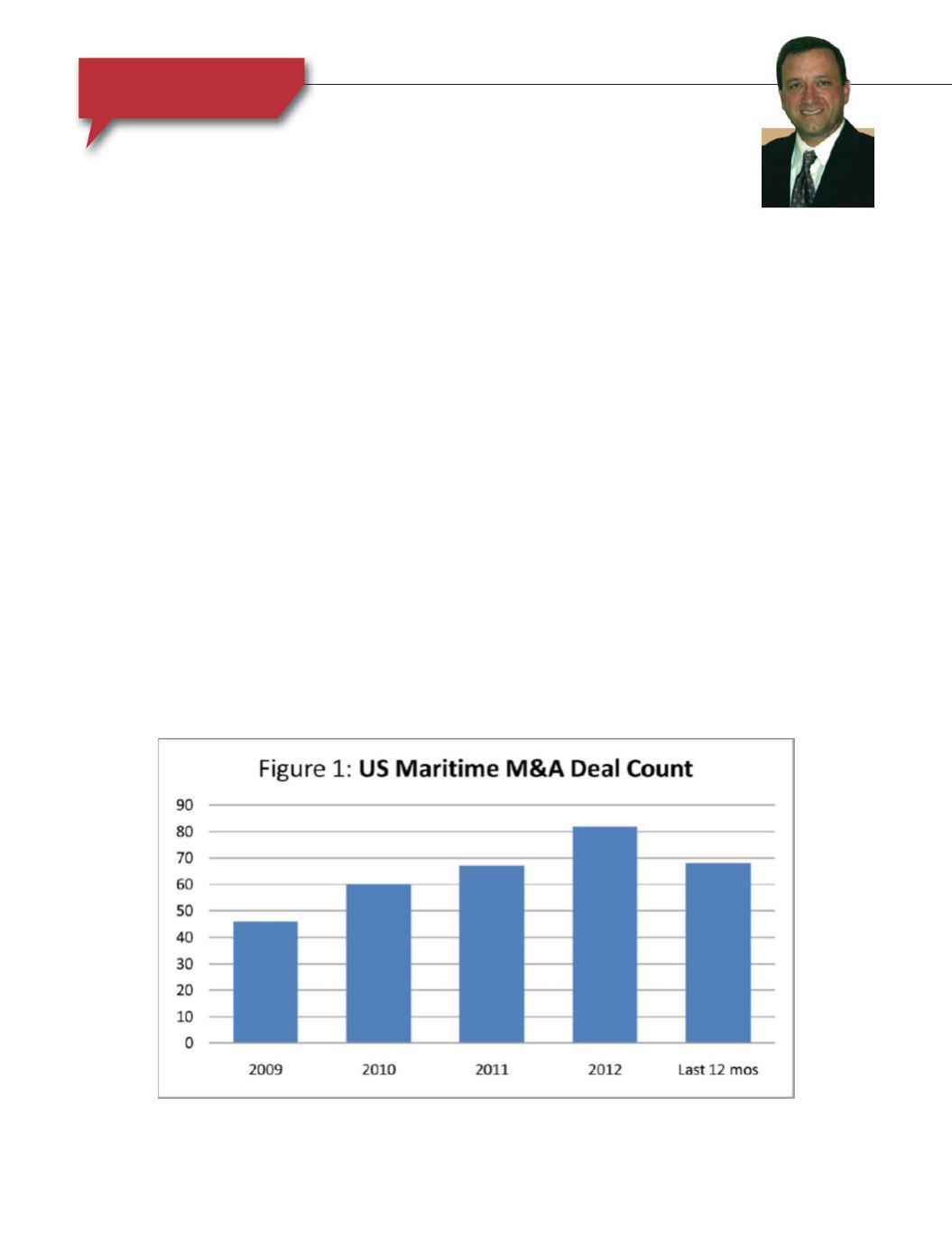

to encourage offshore growth. Merger and Acquisition

volumes have generally expanded in the US along with

this growth as strategic companies seek to strengthen

their positions in niche competencies (Figure 1). As al-

ways, a trickle of less strategic deals has materialized in

response to opportunistic conditions such as regulatory

changes and cases of financial distress.

A recurring theme in our quarterly studies of the ma-

rine deal-making landscape, particularly in North Amer-

ica, is the dominance of inland and offshore workboat

markets. The graph in figure 2 shows the consistency

and general outperformance of the inland/offshore pub-

lic stock indices in comparison with other marine seg-

ments, and the S&P 500 this year. Despite continuous

regulatory challenges, upward momentum in both do-

mestic oil production levels and petroleum price levels

are likely to sustain the positive trends for at least the

near future.

Recent Deals in the Oil Patch

The first deal we examine is a strategic asset deal,

as

Genesis Energy L.P.

(GEL) announced its acquisi-

tion of

Hornbeck Offshore Services’

(HOS) fleet of

oil-transport barges and tug boats for about $230 mil-

lion in July. Genesis operates a fleet of inland barges

and tugs, as well as terminal facilities and oil pipeline

systems. The addition of the Hornbeck vessels adds to

Genesis’ ocean-going capabilities and expands the com-

pany’s presence in the GOM, northeastern US and Great

Lakes region, despite some customer overlap. Shares of

publicly-traded limited partnership Genesis are up more

than 30 percent since the beginning of 2013. Hornbeck’s

shares are up more than 50 percent in the same period,

and the sale of the transport vessels dovetails with the

company’s strategic shift to focus on oil and gas explora-

tion and production.

Maritime & Offshore M&A

Regulatory, Financial & Operational changes drive

strategic deals in the crowded Workboat markets

By Harry Ward

Insights