3

Second Quarter 2016

Noteworthy M&A Activity

Since World War II, the U.S. military periodically undertakes large-scale strategic

initiatives to “offset” perceived deficiencies in its conventional forces. Most recently, the

DoD launched the Defense Innovation Initiative (“DII”) to develop a “third offset

strategy” that counters adversarial advances in Anti-Access/Area Denial (“A2/AD”)

capabilities. Components of the DII budget include

cyber and electronic warfare

,

submarine and undersea warfare

,

autonomous systems and human-machine

teaming

,

A2/AD and anti-A2/AD capabilities

, and

war gaming and concept

development

. A2/AD threatens to disrupt the military’s ability to deploy forces and

establish air, space and maritime superiority. Threats include ballistic missiles designed

to pinpoint key ground facilities, as well as counter-maritime and counter-air systems

targeting mobile assets, including space and cyber assets.

M&A activity suggests that some companies already positioned themselves for these

developments. Transactions relating to these capabilities can be found more than

three years ago, with the A2/AD, Undersea Warfare, and Man/Machine categories

showing an upward trend. For example, Chemring Group acquired missile defense

technology from Wallop Defense Systems providing infrared decoy flare

countermeasures against both air-to-air and ground-to-air missiles. In Undersea

Warfare, Hungtinton Ingalls Industries acquired the Engineering Solutions division of

Columbia Group, which manufactures both manned and unmanned undersea war

vehicles, testing of mine warfare systems, and torpedo countermeasures. Additionally,

General Dynamics Corp. acquired Bluefin Robotics Corp. for its UUV capabilities in

order to integrate UUVs into its existing Naval platforms. The Man/Machine category

extends beyond unmanned vehicles to include human-machine collaboration in the

form of autonomous systems, robots and artificial intelligence. Arlington Capital’s

recently acquired iRobot Corp.’s Defense & Security business brings capabilities

including behavior-based robots that can be deployed in hostile environments to

provide warfighters with invaluable situational awareness while replacing human

casualties.

Industry Trends

(Defense and Government Services)

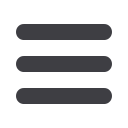

DoD DII Estimated Annual Budget ($ in Billions)

3.0

Undersea Warfare

3.5

A2/AD

1.7

Cyber & Electronic Warfare

3.0

Man/Machine

0.5

Wargaming & Concept

30%

26%

26%

15%

4%

LTM 3

rd

Offset Deals by Category

Buyer

Target

M&A Close Date and Strategic Rationale

Chemring

Group

Wallop Defense

Systems [Assets]

May '16:

Infrared decoy flare countermeasures

against air-to-air and ground-to-air missiles

Arlington

Capital Partners

EOIR

Technologies

Jun '16:

Electromagnetic Maneuver Warfare

Command & Control, among other capabilities

J.F. Lehman &

Co.

API Technologies

Apr '16:

RF, microwave, millimeterwave, and

electromagnetic systems for electronic warfare

Huntington

Ingalls

Industries

Columbia Group

[Engineering

Solutions]

Jan '15:

Manned/unmanned undersea war vehicles,

mine warfare systems, torpedo countermeasures

Kraken Sonar

Systems Inc.

Marine Robotics

Nov '15:

World-class underwater robotics technology

and related intellectual property rights

Arlington

Capital Partners

iRobot

Corp.

[Defense

&

Security]

Apr '16:

Behavior-based robots providing warfighters

with invaluable situational awareness

Braxton

Science

&

Tech. Group

Space/Ground

System Solutions

Mar '16:

Combine expertise to foster innovations in

human-machine collaboration

Veritas Capital

Fund Mgmt.

Alion

Science

and Technology

Aug '15:

Modeling, Simulation, Training, and

Analysis for explosives, robotics and AI

0

5

10

15

20

25

30

35

3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16

A2/AD Electronic Undersea Man/Machine Wargaming

Source: InfoBase; Capital IQ and Industry Newswires