2

Second Quarter 2016

M&A Analysis

Source: Public Filings, InfoBase; Capital IQ as of 6/30/2016

Gov. Services - Notable Trends

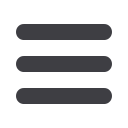

Recent Transaction Activity by Quarter

The McLean Group tracked 33 announced Defense and Government Services sector transactions during Q2 2016, down from Q2 2015’s forty-

three transactions, yet surpassing Q1 2016. Public companies remain the most active buyer category in the second quarter, comprising 43% of

all announced transactions in Q2, highlighted by KBR’s announced acquisition of Wyle, Inc. from private equity firm Court Square Partners for

$570 million. Arlington Capital Partners demonstrated significant M&A activity in Q2 with acquisitions of EOIR Technologies, Columbia Ultimate

Business Systems, Kreisler Manufacturing Corp, and iRobot’s Defense & Security Business. As a whole, private equity activity was down when

compared to the prior quarter, 18% to 38%. Through the first half of the year we have noted 23 divestitures, almost double the previous year, as

companies continue to shed non-core assets and shape their portfolios.

North American Aerospace M&A activity receded in Q2, falling to 31 announced transactions. Acquisitions by buyer were spread fairly evenly

across the board, with private equity buyers outpacing public and private company buyers 35% to 32% and 32% respectively. The largest

reported transaction of the quarter was TransDigm’s acquisition of ILC Holdings, Inc. the parent company of Data Device Corp. from private

equity group Behrman Capital for $1 billion, representing a five times multiple of revenue. Many of the large primes have stated that they are still

pursuing transformational M&A, such as Honeywell even after it cancelled its $90.7 billion offer to buy United Technologies earlier in the year.

Divestitures

Buyer Type

11

9

12

23

1H 2013 1H 2014 1H 2015 1H 2016

43

27

34

32

33

52

33

36

35

31

Q2 2015

Q3 2015

Q4 2015

Q1 2016

Q2 2016

Defense & Government Services

Aerospace

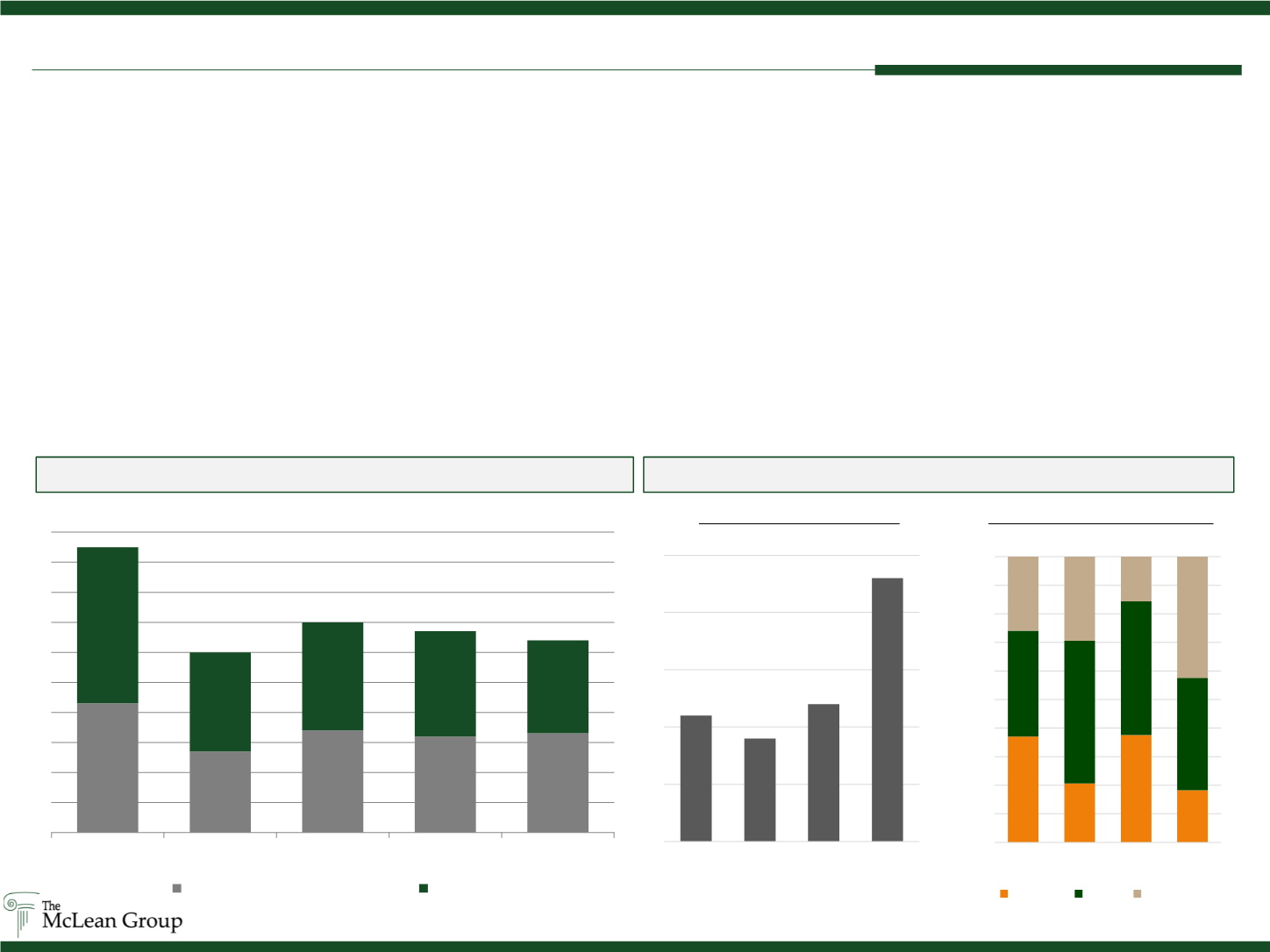

37%

21%

38%

18%

37%

50%

47%

39%

26%

29%

16%

42%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Q3'15 Q4'15 Q1'16 Q2'16

Financial

Public Private