3

As of 12/31/2016

3

Year in Review

2016

M&A Activity Summary

Source: Public Filings, Industry Newswires, S&P Capital IQ

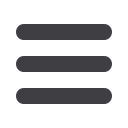

Defense and Government Services Transaction Activity

35

31

32

33

43

42

32

27

37

30

34

45

130

135

156

2014

2015

2016

Q1 Q2 Q3 Q4

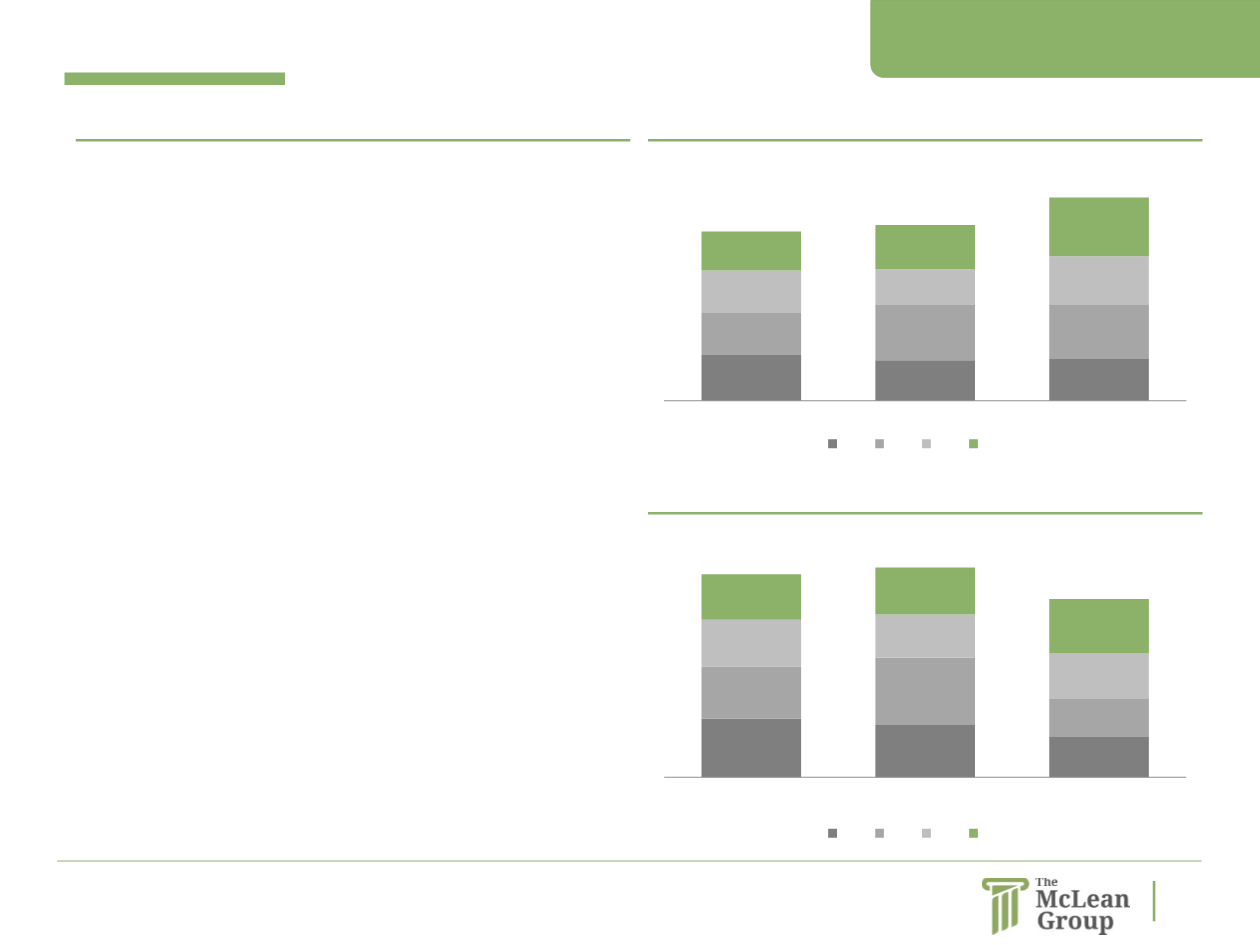

Aerospace Transaction Activity

45

40

31

40

52

29

36

33

35

35

36

42

156

161

137

2014

2015

2016

Q1 Q2 Q3 Q4

The McLean Group tracked 45 announced Defense and Government

Services transactions and 42 announced Aerospace transactions

during Q4 2016.

During 2016, 156 transactions were announced in the Defense and

Government Services sectors, an increase from 135 transactions in

2015. Growth in transaction activity was the result of increased

activity across all buyer groups. Public company buyer activity was

flat, accounting for 40% of transaction volume. Transactions

involving private buyers increased to just over 30% from 26% in

2016. Like 2015, there was a number of mega deals (transactions

greater than $1.0 billion), including Leidos Holdings’ acquisition of

Lockheed Martin’s Information Systems & Global Solutions business

for $4.6 billion.

Aerospace activity was down year-over-year with 137 announced

transactions in 2016, compared to 161 in 2015. While private buyer

activity fueled transactions in 2015, the year-over-year decline in

2016 private buyer activity caused a slowdown in 2016 transaction

activity. Among the largest deals for 2016 was Rockwell Collins’ $8.3

billion acquisition of B/E Aerospace, representing an implied

EV/EBITDA multiple of 13.6x.

M&A Activity Summary