7

2013 Year in Review

3,889

4,014

4,176

4,298

3,125

3,445

3,467

3,680

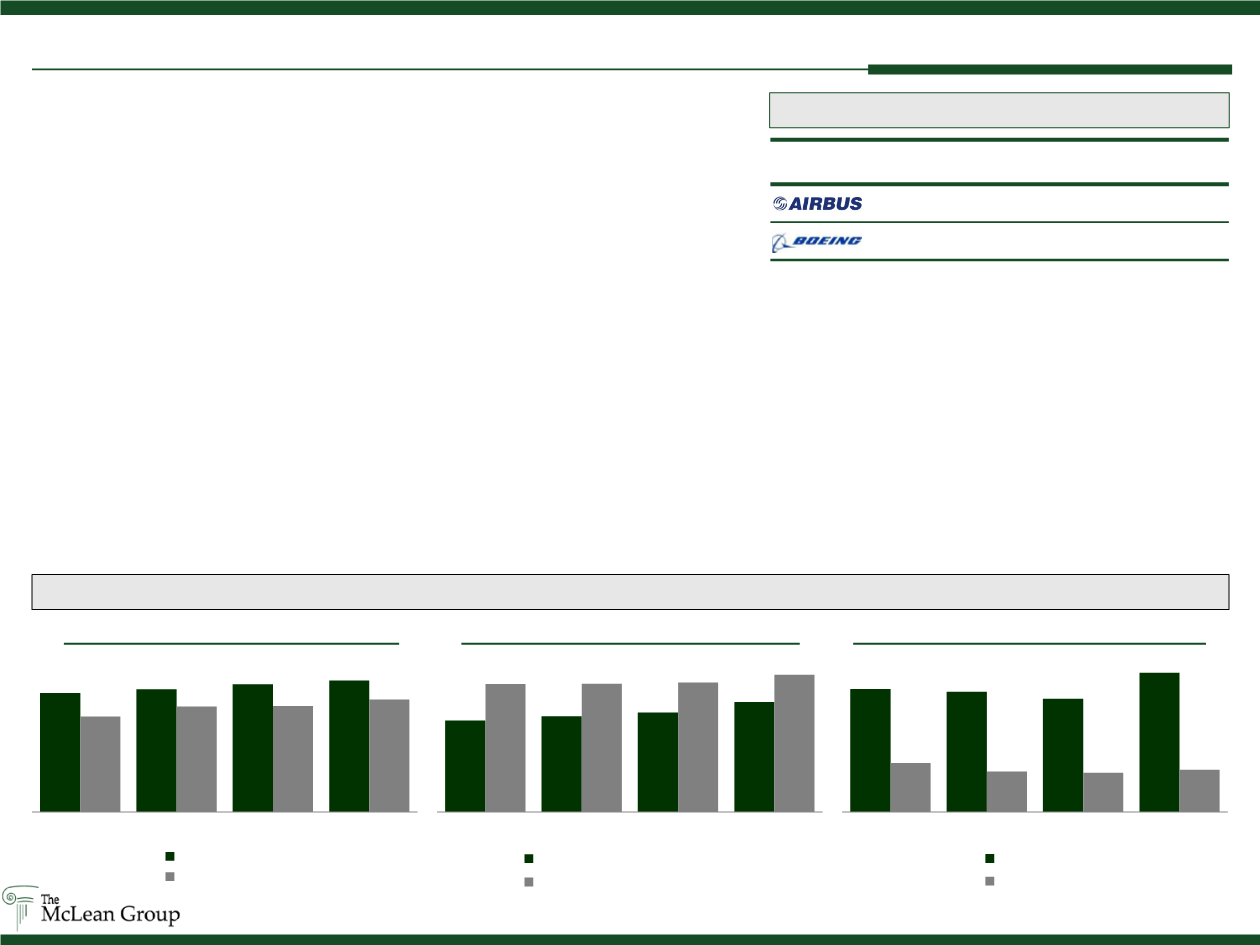

Q1 Close Q2 Close Q3 Close Q4 Close

Airbus A320

Boeing 737

161

157

148

182

64

53

51

55

Q1 Close Q2 Close Q3 Close Q4 Close

Airbus A380

Boeing 747

Narrow body aircraft orders were driven by big sales in Europe and the Asia-Pacific where economy airlines are scaling up to capitalize

on large forecasted increases in passenger traffic. Airbus booked significant orders for its A320neo at the Paris Airshow and the China Air

Expo and secured a $22 billion order for 220 A320s from International Airlines Group. Boeing also booked large orders for its 737 MAX at

these events in addition to a Q1 $18 billion order from Ryanair for 200 737s. Indonesia’s Lion Air grabbed headlines twice when it ordered

230 737s in Q1 and 234 A320/A321s in Q2, a combined order value of nearly $50 billion.

Widebody aircraft sales were propelled by huge orders at the Dubai Airshow for new fuel efficient designs. Middle Eastern airlines placed

orders at the Airshow valued at nearly $150 billion including 225 777Xs, 30 787s, 50 A350s, and 50 A380s. Boeing’s 787 orders

remained stable despite several safety issues. However, Boeing’s 787 troubles may have materialized in Japan with Japan Airlines’

landmark $9.5 billion order for 31 Airbus A350s, which threatens Boeing’s near exclusivity in that market. Boeing’s 747 sales remained

stagnate but the market is expected to return in 2014 with the introduction of the stretched, next-generation 747-8.

Strong Commercial Aerospace Sales

Source: Open Sources, Boeing and Airbus Public Filings

Commercial Aircraft sales continued their steady climb in 2013 with Airbus and

Boeing’s combined backlog growing more than 17% from 9,055 to 10,639. Boeing

retained its status as world’s top planemaker, delivering 648 aircraft. However,

Airbus captured more new sales, booking 1,619 gross orders. Order growth was

driven by two key factors: 1) growing middle classes, especially in Asia-Pacific and

2) new fuel-efficient aircraft options accelerating carrier replacement schedules.

Company Deliveries Gross New

Orders

Net New

Orders Backlog

588

1,619

1,503

5,559

648

1,531

1,355

5,080

2013 Commercial Aircraft Sales Summary

Quarterly Backlog by Operational Design Family

Short / Medium-Range, Narrow-Body

Long-Range Wide-Body Twin-Engine

Double-Deck, Wide-Body, Four-Engine

898

938

975

1,079

1,256

1,259

1,269

1,345

Q1 Close Q2 Close Q3 Close Q4 Close

Airbus A330 / A340 / A350

Boeing 767 / 777 / 787